Post-Merger Analytics Integration

Our data-driven approach from

Growth at all Costs

to

Efficient revenue growth

Our dual fluency in Data Engineering & Business Strategy enables our cross-functional support

SALES: GTM, RevOps

Sales Led Growth (SLG)

Product Led Growth (PLG)

AI enablement

FINANCE: FP&A, Corp. Dev.

Evolving beyond Excel reporting

Integrating Bookings with Financials

Efficient diligence partner

IT, Data Engineering & Analytics

Data Warehousing & Governance

Efficient IT Strategy

AI integration

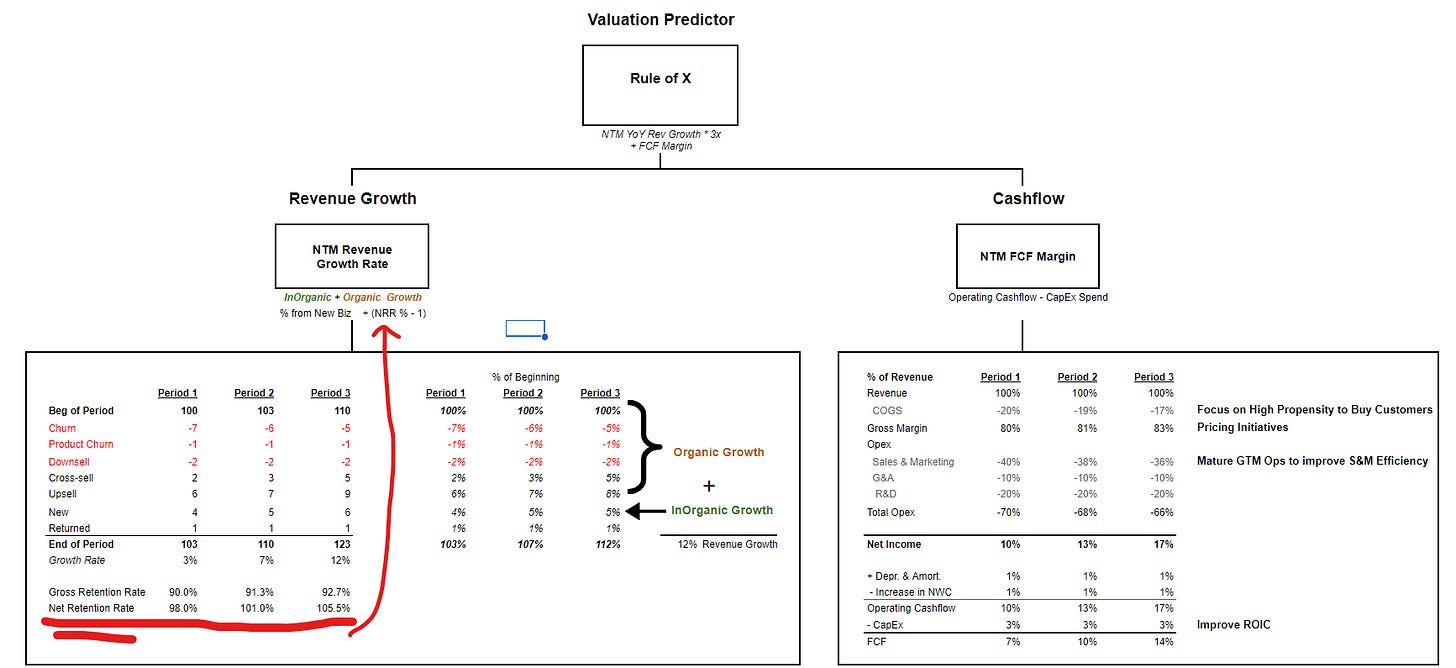

Our Efficiency Framework

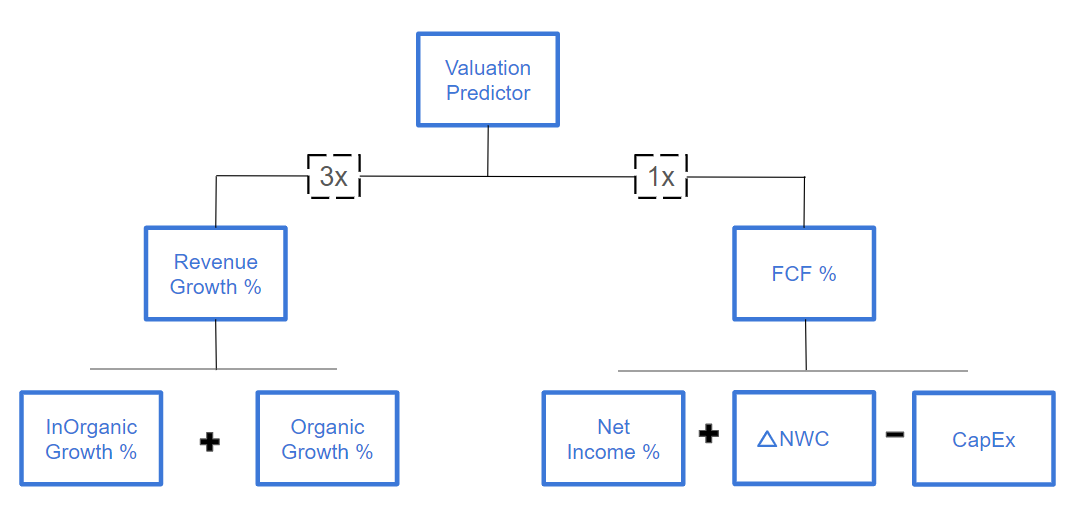

We help companies build a 3:1 ratio of Revenue Growth to Free Cash Flow. This means for every 3% points of YoY Revenue growth a company should generate 1% of Free Cash Flow.

Example of an Efficient SaaS company:

- 24% YoY Revenue Growth

- 7% Free Cash Flow

Common problems we solve

"I like our analytics team, but they are just junior in some areas."

Our MBRs need to be better

We have a team of coders, not analyst

Getting the data I need should be easier

"We lack an understanding of our customer growth drivers"

What product mix do our best customers start with? What do they buy next and when?

What opportunity sources are our best customers coming from?

Why is our Net Retention Rate is decreasing?

Why are our Sales Reps always complaining about the wrong kind of leads. What makes a good lead for us?

"Our GRR is decreasing, but we don't know the root cause"

Is our drop in gross retention due to:

Down sells? Are customers using less seats/licenses? Is this a customer segment issue or is the market softening?

Product churn? Which customer segments are dropping products the most often? Which products are dropped the most? Why are customers canceling products is it a feature issue or a customer success issue?

Increased churn? Why are our customers churning? Which cohorts have the lowest retention? What are the leading indicators of churn?

"Our revenue engine feels like it's stuck in 2nd gear"

Why can't our sales reps forecast their pipe?

We have all this data, why don't we have a propensity to buy model?

Why don't the sales, marketing, and product teams work better together?

"Strategic planning is so exhausting here"

We don't have the data we need when we need it.

We don't do bottoms-up account planning.

We are given unrealistic targets without any input.

"I'm not sure our team is ready to take on a Merger or Acquisition"

We need to acquire & integrate a company, but our team lacks the experience.

Our data is a mess, I don't want to have to integrate someone else's messy data systems too.

We just got our culture & process right. I don't want some new team coming in here and messing it up.

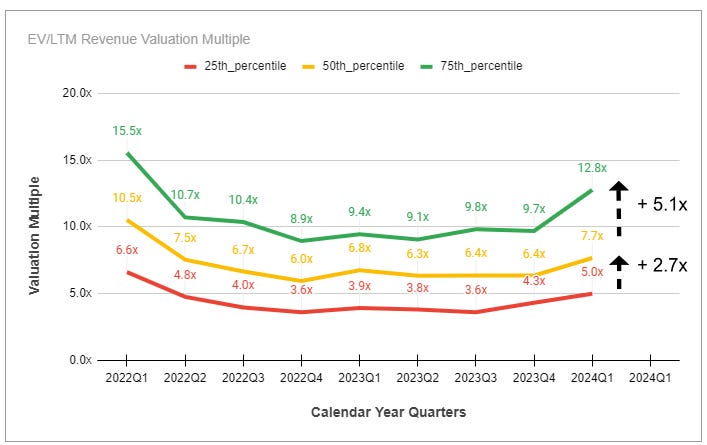

"How do we compare to industry benchmarks?"

What is our current valuation? Is it good or bad?

How much would 5% revenue growth increase our valuation?

How much would 5% FCF or EBTIDA growth increase our valuation?